Wealth Management Advisor Near Me: What Services Are Included sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In the following paragraphs, we will delve into the various services provided by wealth management advisors, the importance of seeking local advisors, and how to find the right advisor to meet your financial needs.

Wealth Management Advisor Overview

A wealth management advisor plays a crucial role in helping individuals and families manage their finances, investments, and overall wealth. They provide expert guidance and personalized strategies to help clients achieve their financial goals and secure their financial future.

It is important to seek the services of a wealth management advisor to ensure that your financial resources are being managed effectively and efficiently. These professionals have the knowledge and experience to navigate complex financial markets and help you make informed decisions that align with your financial objectives.

Primary Responsibilities of a Wealth Management Advisor

- Assessing the client's financial situation, goals, and risk tolerance to develop a customized wealth management plan.

- Monitoring and managing investment portfolios to optimize returns and minimize risks.

- Providing ongoing financial advice and guidance to help clients navigate changing market conditions and life events.

- Collaborating with tax professionals and estate planners to ensure comprehensive wealth management strategies.

- Regularly reviewing and adjusting the financial plan to reflect changes in the client's financial situation or goals.

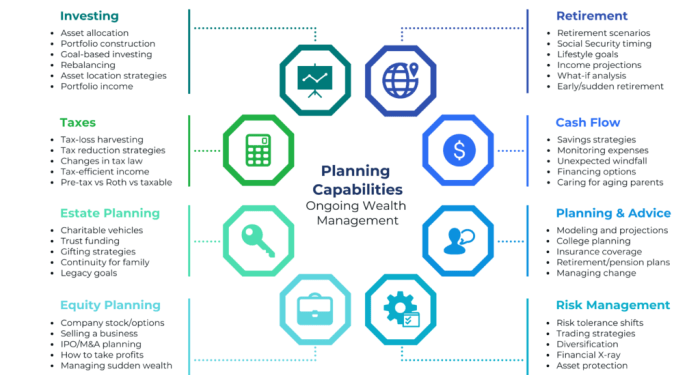

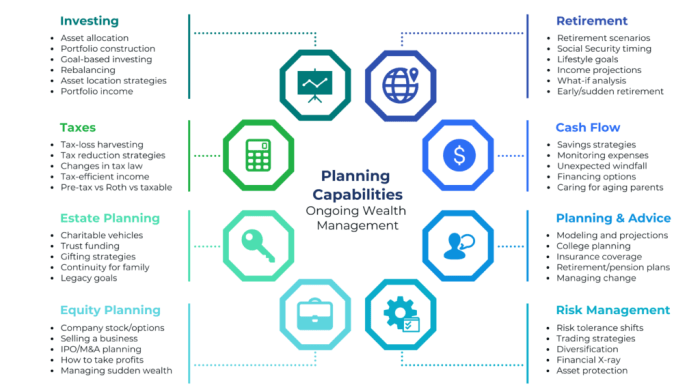

Services Offered by Wealth Management Advisors

Wealth management advisors offer a range of services to help individuals and families manage their finances effectively and achieve their financial goals. These services often include financial planning and investment management among others.

Financial Planning Services

- Assessment of current financial situation

- Goal setting and financial goal planning

- Retirement planning

- Estate planning

- Tax planning

- Insurance planning

Investment Management Services

- Portfolio analysis and asset allocation

- Investment selection and monitoring

- Risk management

- Performance evaluation

- Rebalancing of investment portfolios

Importance of Local Wealth Management Advisors

Local wealth management advisors play a crucial role in helping individuals navigate their financial goals and secure their future. Here are some key reasons why working with a local advisor can be beneficial:

Personalized Services

Local wealth management advisors have a deep understanding of the community they serve, allowing them to tailor their services to meet the unique needs of their clients. This personalized approach ensures that individuals receive customized financial advice that aligns with their specific goals and circumstances.

Face-to-Face Interactions

One of the major advantages of working with a local wealth management advisor is the opportunity for face-to-face interactions. Meeting in person allows for a more personal and engaging experience, where clients can build a strong relationship with their advisor and feel more confident in discussing their financial concerns openly.

Local Expertise

Local wealth management advisors possess a wealth of knowledge about the local market, regulations, and opportunities that can benefit their clients. This expertise can be invaluable in guiding individuals towards making informed decisions that are in their best financial interest.

Finding the Right Wealth Management Advisor

Finding the right wealth management advisor is crucial for your financial well-being. Here are some steps to help you find a reputable advisor near you and compare different options based on their services and expertise.

Steps to Find a Reputable Wealth Management Advisor Near You

- Research Local Advisors: Start by researching wealth management advisors in your area to find options that are convenient for you to meet with in person.

- Check Credentials: Look for advisors who are certified and have relevant qualifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Read Reviews: Search for reviews and testimonials from clients to get an idea of the advisor's reputation and quality of service.

- Interview Multiple Advisors: Schedule consultations with different advisors to discuss your financial goals and assess their approach to wealth management.

Criteria to Consider When Selecting a Wealth Management Advisor

- Experience: Choose an advisor with a proven track record and experience in managing wealth for clients with similar financial goals.

- Services Offered: Consider the range of services offered by the advisor, including investment management, retirement planning, tax optimization, and estate planning.

- Fee Structure: Understand how the advisor charges fees, whether it's based on assets under management, hourly rates, or a flat fee, and choose a structure that aligns with your preferences.

- Communication Style: Select an advisor who communicates clearly and regularly with you, keeping you informed about your financial progress and any changes to your investment strategy.

Last Recap

As we reach the end of this discussion on wealth management advisors, it is evident that their role is crucial in helping individuals navigate the complexities of financial planning. Whether you are looking for investment management services or personalized financial guidance, a local wealth management advisor can provide the expertise you need to secure your financial future.

Detailed FAQs

What specific services do wealth management advisors offer?

Wealth management advisors typically offer services such as financial planning, investment management, retirement planning, tax planning, and estate planning.

How can a local wealth management advisor benefit me?

Local wealth management advisors can offer personalized services tailored to your individual financial goals and circumstances. They also provide the advantage of face-to-face interactions for a more hands-on approach to financial planning.

What criteria should I consider when selecting a wealth management advisor?

When selecting a wealth management advisor, consider factors such as their expertise, experience, qualifications, fee structure, and the range of services they offer. It's important to choose an advisor who aligns with your financial goals and values.