Delving into the realm of asset protection, it becomes evident why wealth planning services play a pivotal role in safeguarding one's financial well-being. By exploring the intricate strategies and legal considerations involved, this discussion sheds light on the paramount importance of proactive wealth planning for individuals and businesses alike.

As we navigate through the various facets of wealth planning services, we unravel the key strategies and risk management techniques crucial for long-term asset preservation. Join us on this enlightening journey to understand why asset protection is synonymous with prudent wealth planning.

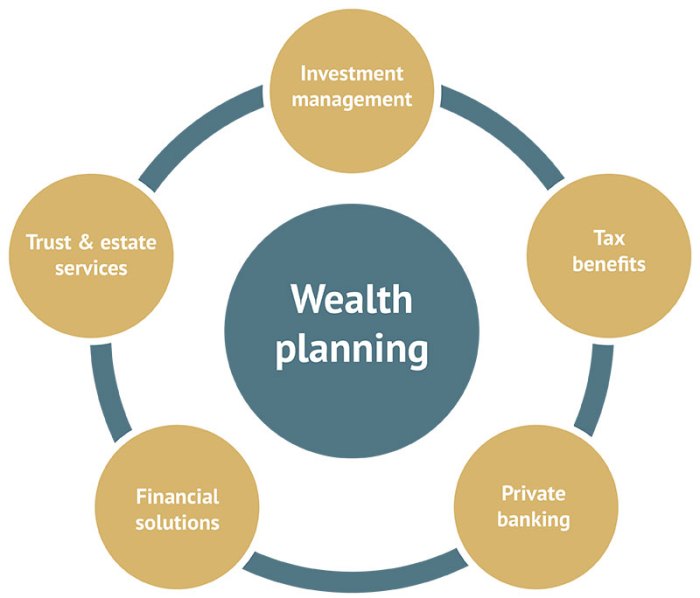

Importance of Wealth Planning Services

Wealth planning services play a crucial role in asset protection by helping individuals and businesses safeguard their assets from potential risks and ensure long-term financial stability.

Asset Protection through Wealth Planning

- Establishing trusts and wills: Wealth planning services can assist in setting up trusts and drafting wills to ensure that assets are distributed according to the individual's or business owner's wishes.

- Insurance coverage: Wealth planners can recommend appropriate insurance policies to protect assets from unforeseen events such as lawsuits, accidents, or natural disasters.

- Diversification of investments: By diversifying investment portfolios, wealth planning services can help mitigate risks and protect assets from market fluctuations.

Benefits of Proactive Wealth Planning

- Minimizing tax liabilities: Wealth planners can develop tax-efficient strategies to minimize tax burdens and maximize wealth accumulation over time.

- Preserving wealth for future generations: Through proper estate planning, wealth planning services can help individuals pass on their assets to heirs while minimizing estate taxes and probate costs.

- Ensuring financial security: By creating a comprehensive wealth management plan, individuals and businesses can secure their financial future and achieve their long-term financial goals.

Key Strategies for Asset Protection

When it comes to safeguarding assets through wealth planning, there are several key strategies that individuals can utilize to protect their wealth and investments. These strategies are essential in ensuring financial security and stability for the long term.

Diversification of Assets

Diversification is a fundamental strategy in asset protection through wealth planning. By spreading investments across different asset classes such as stocks, bonds, real estate, and commodities, individuals can reduce the risk of significant losses due to market fluctuations. Diversification helps in minimizing the impact of downturns in any single asset class, thus safeguarding overall wealth.

Asset Protection Trusts

Asset protection trusts are legal structures that can be established to protect assets from creditors, lawsuits, and other potential risks. These trusts allow individuals to transfer ownership of assets to a trustee, who manages the assets on behalf of the beneficiaries.

Asset protection trusts provide a level of protection against creditors and legal claims, ensuring that assets are shielded from potential threats.

Estate Planning

Estate planning is another crucial strategy for asset protection. By creating a comprehensive estate plan, individuals can ensure that their assets are distributed according to their wishes and are protected from unnecessary taxes and probate costs. Estate planning involves the use of tools such as wills, trusts, and powers of attorney to safeguard assets for future generations.

Legal Considerations in Wealth Planning

When it comes to wealth planning, legal considerations play a crucial role in ensuring the effectiveness of asset protection strategies. It is essential to understand the legal frameworks that impact asset protection and the role of legal compliance in wealth planning services.

Legal Frameworks Impacting Asset Protection Strategies

Legal frameworks such as estate laws, tax regulations, and business structures have a significant impact on asset protection strategies. Estate laws dictate how assets are distributed upon death, while tax regulations determine the tax implications of wealth transfer. Business structures, on the other hand, can affect how assets are owned and managed, influencing their protection.

Importance of Legal Compliance in Wealth Planning Services

Legal compliance is crucial in wealth planning services to ensure that asset protection strategies are valid and enforceable. Failure to comply with relevant laws and regulations can render asset protection measures ineffective and expose assets to potential risks. Working with legal experts helps ensure that wealth planning strategies are legally sound and provide the intended protection for assets.

Legal Expertise in Effective Asset Protection

Legal expertise is essential in developing and implementing effective asset protection strategies. Legal professionals have the knowledge and experience to navigate complex legal frameworks, identify potential risks, and create tailored solutions to protect assets. By leveraging legal expertise, individuals can safeguard their wealth and mitigate the impact of unforeseen legal challenges.

Risk Management in Wealth Planning

Risk management plays a crucial role in developing effective asset protection plans. By identifying potential risks and implementing strategies to mitigate them, individuals can safeguard their wealth and ensure long-term financial security.

Role of Risk Assessment

Risk assessment is a key component of wealth planning services as it helps individuals understand the potential threats to their assets. By conducting a thorough evaluation of various risk factors such as market volatility, economic downturns, and legal liabilities, wealth planners can tailor asset protection plans to address specific vulnerabilities.

- Conducting a comprehensive review of current assets and liabilities to identify areas of potential risk.

- Assessing the impact of external factors such as changes in the regulatory environment or market conditions on asset value.

- Developing contingency plans to mitigate risks and protect assets in the event of unforeseen circumstances.

Risk Management Strategies

Wealth planners employ a variety of risk management strategies to protect assets and minimize exposure to potential threats. These strategies may include diversifying investment portfolios, purchasing insurance coverage, establishing trust structures, and implementing asset protection vehicles such as limited liability companies (LLCs) or family partnerships.

- Diversification: Spreading investments across different asset classes to reduce concentration risk and minimize potential losses.

- Insurance: Obtaining adequate insurance coverage to protect against risks such as property damage, liability claims, or loss of income.

- Trust Structures: Setting up trusts to shield assets from creditors, lawsuits, or other legal risks.

- Asset Protection Vehicles: Utilizing legal entities like LLCs or family partnerships to separate personal assets from business liabilities and safeguard wealth.

Impact on Long-Term Asset Preservation

Effective risk management is essential for ensuring the long-term preservation of assets and wealth. By proactively identifying and addressing potential risks, individuals can protect their financial resources from unforeseen events and secure their legacy for future generations. Implementing sound risk management strategies can help individuals navigate economic uncertainties, market fluctuations, and legal challenges, ultimately safeguarding their wealth for years to come.

Epilogue

In conclusion, the synergy between wealth planning services and asset protection emerges as a cornerstone for financial security and stability. By embracing the insights shared in this discourse, individuals and businesses can fortify their assets against potential risks and uncertainties, paving the way for a prosperous future.

Query Resolution

What are some common strategies used in wealth planning for asset protection?

Common strategies include diversification of assets, setting up trusts, and utilizing insurance policies to shield wealth from potential threats.

How does legal compliance impact wealth planning services?

Legal compliance ensures that wealth planning strategies adhere to existing regulations, thus safeguarding assets from legal challenges and disputes.

What is the significance of risk assessment in developing asset protection plans?

Risk assessment allows individuals and businesses to identify potential threats to their assets, enabling them to implement tailored strategies for protection and preservation.