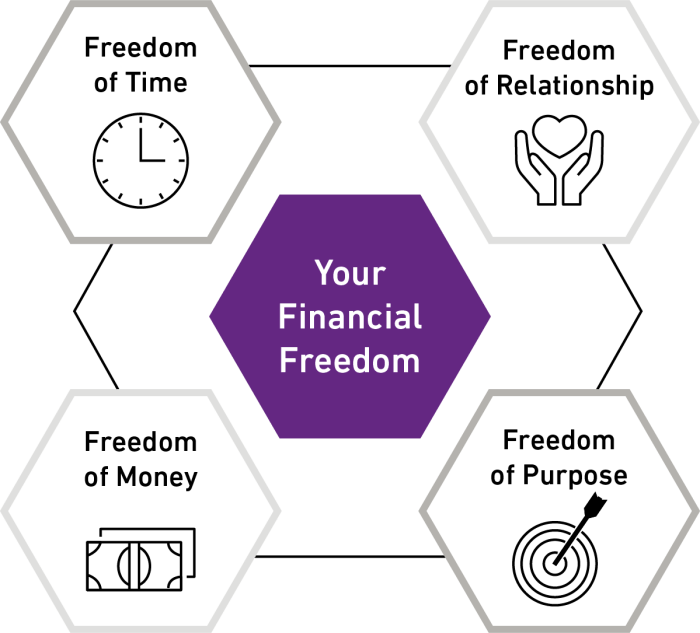

Exploring the significance of PWM Finance for high income professionals, this introduction sets the stage for a detailed discussion on the key aspects of wealth management. It delves into the crucial role PWM plays in optimizing financial strategies for individuals with high incomes, offering a glimpse into the tailored services, investment strategies, and risk management techniques that are essential for their financial success.

Importance of PWM Finance for High Income Professionals

High income professionals often face unique financial challenges and opportunities that require specialized strategies to manage their wealth effectively. Private Wealth Management (PWM) finance plays a crucial role in helping these individuals navigate their financial complexities and achieve their long-term financial goals.

Optimizing Investment Portfolios

One key aspect of PWM finance for high income professionals is the optimization of investment portfolios. PWM advisors can tailor investment strategies to align with the individual's risk tolerance, time horizon, and financial objectives. By diversifying assets across different classes and sectors, PWM helps maximize returns while minimizing risks.

Tax Efficiency

Another vital component of PWM finance is optimizing tax efficiency for individuals with high incomes. PWM advisors can implement tax strategies such as tax-loss harvesting, tax-deferred investments, and charitable giving to help reduce tax liabilities and preserve wealth over time.

By minimizing tax burdens, high income professionals can retain more of their earnings and grow their wealth more effectively.

Estate Planning

PWM finance also plays a crucial role in estate planning for high income professionals. By working with PWM advisors, individuals can develop comprehensive estate plans that ensure their assets are distributed according to their wishes and minimize estate taxes. Through strategies such as trusts, gifting, and insurance, PWM helps high income professionals protect their wealth for future generations.

Tailored Financial Planning in PWM for High Income Professionals

Tailored financial planning in Private Wealth Management (PWM) is crucial for high income professionals as it offers personalized solutions to meet their unique financial goals and needs. PWM services are designed to cater specifically to the intricate financial situations of individuals with high incomes, ensuring that their wealth is managed effectively and efficiently.

Customized Wealth Management Plans

PWM advisors work closely with high income clients to develop personalized wealth management plans that take into account their income levels, risk tolerance, investment objectives, and long-term financial goals. These plans are tailored to each individual's specific circumstances, ensuring that they are well-equipped to navigate the complexities of managing substantial wealth.

- Advisors conduct in-depth assessments of high income clients' financial situations to understand their current assets, liabilities, and cash flow patterns.

- They then work collaboratively with clients to establish investment strategies that align with their risk preferences and financial objectives.

- Advisors continuously monitor and adjust these plans as needed to adapt to changing market conditions, financial goals, or personal circumstances.

Benefits of Personalized Financial Planning

Personalized financial planning in PWM offers several benefits to high income professionals, including:

- Maximizing investment returns: Tailored wealth management plans aim to optimize investment returns while managing risk effectively.

- Minimizing tax liabilities: Advisors help high income clients implement tax-efficient strategies to minimize their tax burden and maximize after-tax returns.

- Ensuring long-term financial security: By developing personalized plans, PWM advisors help high income professionals secure their financial future and achieve their wealth accumulation goals.

Investment Strategies in PWM for High Income Professionals

When it comes to managing wealth for high income professionals, employing effective investment strategies is crucial to ensure long-term financial growth and stability. PWM advisors work closely with their clients to develop tailored investment plans that align with their financial goals and risk tolerance.

Asset Allocation

One of the key strategies in PWM is asset allocation, where advisors distribute a client's investment portfolio across different asset classes such as stocks, bonds, real estate, and alternative investments. This helps to spread risk and optimize returns based on the client's financial objectives

Diversification

Diversification is another essential strategy in PWM for high income professionals. By spreading investments across various industries, sectors, and geographic regions, advisors can minimize the impact of market fluctuations on the overall portfolio. This reduces the risk of significant losses and helps maintain a more stable investment performance over time.

Risk Management and Wealth Preservation in PWM for High Income Professionals

Risk management plays a crucial role in preserving the wealth of high income individuals in Private Wealth Management (PWM). By implementing effective risk management strategies, PWM advisors aim to protect and grow the assets of their high income clients. Let's explore some of the key techniques employed in PWM to safeguard the financial interests of high income professionals.

Diversification of Investment Portfolio

One of the primary strategies used in PWM for high income professionals is diversification of the investment portfolio. By spreading investments across different asset classes, industries, and geographic regions, advisors can reduce the risk of significant losses due to market fluctuations in any particular sector.

Asset Allocation and Rebalancing

PWM advisors often focus on asset allocation and regular rebalancing to manage risk effectively. By allocating assets based on the client's risk tolerance, investment goals, and time horizon, advisors ensure a balanced portfolio that can withstand market volatility. Regular rebalancing helps maintain the desired asset allocation and reduces exposure to unnecessary risk.

Use of Hedging Strategies

Hedging strategies are commonly used in PWM to protect against potential losses. Techniques such as options, futures, and derivatives are employed to offset risks in the portfolio and preserve wealth. By strategically hedging certain positions, high income professionals can mitigate downside risk while still participating in market opportunities.

Risk Monitoring and Assessment

Continuous monitoring and assessment of risk are essential in PWM to identify potential threats to the client's wealth. By staying vigilant and adapting to changing market conditions, advisors can proactively manage risks and take timely action to protect the financial interests of high income individuals.

Final Summary

In conclusion, the discussion on Why PWM Finance Is Essential for High Income Professionals sheds light on the importance of personalized financial planning, strategic investment decisions, and risk management in safeguarding and growing wealth for high income individuals. By understanding the tailored approach of PWM services, high income professionals can navigate their financial journey with confidence and efficiency.

Common Queries

How can PWM Finance help high income professionals achieve their financial goals?

PWM Finance offers customized wealth management plans tailored to the unique needs of high income individuals, optimizing their financial strategies for long-term success.

What are the benefits of personalized financial planning in PWM for high income professionals?

Personalized financial planning in PWM ensures that high income individuals have strategies in place to meet their specific financial objectives and secure their financial future.

Why is diversification important in investment portfolios for high income professionals in PWM?

Diversification helps minimize risk and maximize returns for high income individuals by spreading investments across different asset classes.

How do PWM advisors preserve wealth for high income clients through risk management?

PWM advisors employ various risk mitigation techniques to protect and grow the assets of high income clients, ensuring their financial interests are safeguarded.