Exploring the realm of Multi Family Office Services and their benefits for Ultra High Net Worth Families, this article delves into the tailored financial planning, estate planning, tax optimization, and concierge services provided by these specialized entities.

Benefits of Multi Family Office Services

Multi family office services offer a range of benefits to ultra high net worth families, providing personalized and comprehensive financial solutions tailored to their specific needs. These services go beyond traditional wealth management firms, offering a more holistic approach to wealth preservation and generational wealth transfer.

Key Advantages of Multi Family Office Services

- Personalized Financial Planning: Multi family offices create customized financial plans based on the unique goals and objectives of each family, taking into account their complex financial structures and diverse assets.

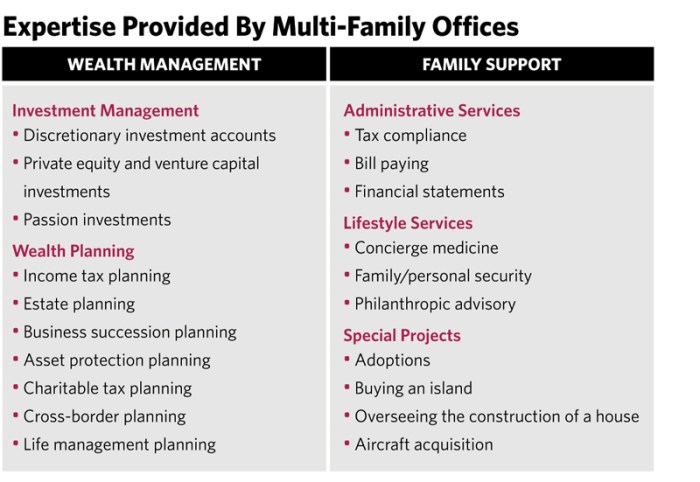

- Integrated Wealth Management: Unlike traditional wealth management firms that focus solely on investment management, multi family offices offer a wide range of services, including tax planning, estate planning, risk management, and philanthropic strategies.

- Family Governance and Education: Multi family offices assist families in establishing governance structures, facilitating communication among family members, and providing education on financial literacy and wealth management best practices.

Wealth Preservation and Generational Wealth Transfer

- Long-Term Perspective: Multi family offices help families develop long-term strategies to preserve wealth across generations, ensuring that assets are protected and managed effectively over time.

- Succession Planning: By implementing comprehensive succession plans, multi family offices assist families in transferring wealth to future generations in a tax-efficient manner, while also preserving family values and legacy.

- Risk Management: Multi family offices provide risk management solutions to safeguard assets from market volatility, economic uncertainties, and other external threats, ensuring the sustainability of the family's wealth over time.

Customized Financial Planning

Customized financial planning is a crucial aspect of multi family office services for ultra high net worth families. These offices work closely with each family to create tailored financial plans that align with their unique goals, risk tolerance, and financial situation.

Personalized Investment Strategies

Multi family offices develop personalized investment strategies for ultra high net worth families by conducting in-depth discussions to understand their financial objectives, time horizons, and risk appetite. For example, a family looking to preserve wealth for future generations may opt for a conservative investment approach focused on long-term growth and stability.

On the other hand, a family with a higher risk tolerance may choose a more aggressive strategy to maximize returns.

Adaptability to Market Conditions

One of the key benefits of multi family office services is the ability to adapt financial plans to changing market conditions. By staying informed about market trends and economic developments, these offices can make timely adjustments to investment portfolios to mitigate risks and capitalize on opportunities.

Additionally, as family dynamics evolve over time, multi family offices can modify financial plans to accommodate new goals or changes in the family structure.

Estate Planning and Tax Optimization

Estate planning and tax optimization are crucial components of financial management for ultra high net worth families. Multi family offices play a key role in helping these families navigate complex tax laws and regulations to minimize tax liabilities and preserve wealth for future generations.

Strategies for Tax Efficiency

Multi family offices employ various strategies to optimize tax efficiency and reduce the tax burden on ultra high net worth families. These may include:

- Setting up family trusts to protect assets and minimize estate taxes.

- Utilizing charitable giving strategies to benefit both the family and philanthropic causes while reducing tax liabilities.

- Implementing strategic gifting plans to transfer wealth to future generations tax-efficiently.

- Leveraging tax-deferred investment vehicles to maximize returns and minimize tax exposure.

Role of Multi Family Offices in Structuring Tax Vehicles

Multi family offices play a critical role in structuring tax-efficient vehicles such as trusts, foundations, and other entities to help ultra high net worth families achieve their estate planning goals. These vehicles are designed to:

- Facilitate wealth transfer with minimal tax implications.

- Protect assets from creditors and legal disputes.

- Enable efficient succession planning to ensure smooth transitions of wealth between generations.

Concierge Services and Lifestyle Management

In addition to financial and estate planning, multi family offices offer concierge services to cater to the unique lifestyle needs of ultra high net worth families, ensuring a seamless and luxurious experience in all aspects of their lives.

Luxury Asset Management

Multi family offices assist ultra high net worth families in managing their luxury assets such as yachts, private jets, and fine art collections. They provide expert advice on acquisition, maintenance, and liquidation of these assets, ensuring that they are well-maintained and optimized for the family's enjoyment and investment purposes.

Travel Arrangements

From booking private charters to arranging exclusive accommodations, multi family offices take care of all travel arrangements for ultra high net worth families. They ensure a hassle-free and luxurious travel experience, personalized to the family's preferences and requirements, whether for business or leisure.

Philanthropic Endeavors

Multi family offices assist ultra high net worth families in managing their philanthropic efforts by identifying charitable causes aligned with their values and goals. They help in setting up foundations, organizing charitable events, and maximizing the impact of their donations, allowing families to make a difference in the world while receiving tax benefits.

Importance of Personalized Lifestyle Management

Personalized lifestyle management is crucial for ultra high net worth families as it allows them to focus on their priorities while delegating time-consuming tasks to experts. By tailoring services to meet the specific needs and preferences of each family member, multi family offices ensure a high level of satisfaction and quality of life for their clients.

Conclusion

In conclusion, Multi Family Office Services offer a comprehensive approach to wealth management, catering to the unique needs of Ultra High Net Worth Families. From personalized financial plans to lifestyle management, these services ensure the preservation and growth of family wealth across generations.

Popular Questions

How do Multi Family Office Services differ from traditional wealth management firms?

Multi Family Offices provide tailored services specifically designed for the complex needs of Ultra High Net Worth Families, focusing on long-term wealth preservation and generational wealth transfer.

What are some examples of concierge services offered by Multi Family Offices?

These services may include luxury asset management, travel arrangements, philanthropic support, and other personalized lifestyle management services.