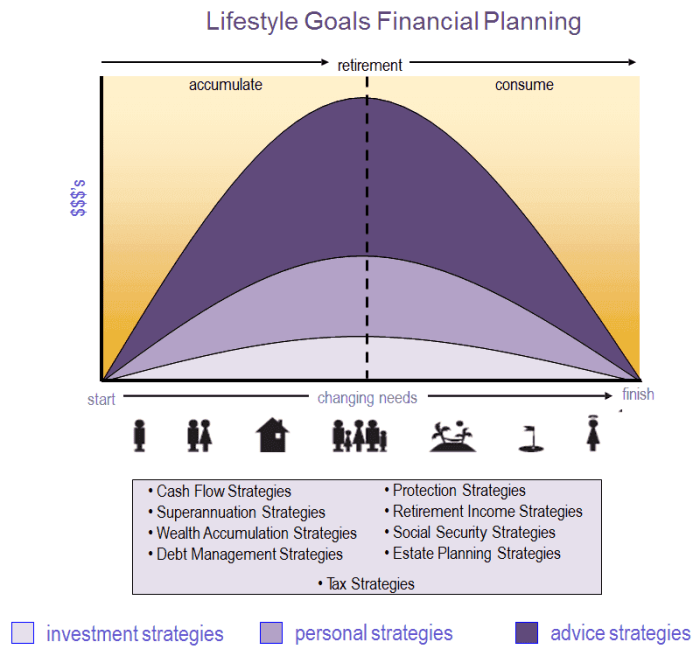

Delve into the world of aligning financial goals with lifestyle through the lens of wealth planning services. This captivating introduction sets the stage for a comprehensive exploration of how these two crucial aspects intertwine to shape our financial future.

Explore the intricacies of financial planning and lifestyle choices as they converge to create a roadmap towards a more secure and fulfilling financial life.

Understanding Wealth Planning Services

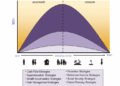

Wealth planning services encompass a range of financial strategies and solutions designed to help individuals manage and grow their wealth effectively. These services involve setting specific financial goals, creating a plan to achieve them, and making informed decisions to secure financial stability over the long term.

Examples of Financial Goals

- Retirement planning: Saving and investing to ensure a comfortable retirement.

- Wealth accumulation: Growing assets through investments and other financial vehicles.

- Education funding: Setting aside money for children's college expenses.

- Debt management: Paying off debts and improving financial health.

The Importance of Aligning Financial Goals with Lifestyle Choices

It is crucial to align financial goals with lifestyle choices to ensure that individuals can maintain their desired standard of living while working towards their financial objectives. For example, if someone values travel and adventure, their financial plan should include provisions for these activities without compromising their long-term financial security.

By integrating lifestyle preferences into wealth planning, individuals can enjoy the present while building a solid financial foundation for the future.

Components of Wealth Planning

When it comes to wealth planning services, several key components play a crucial role in helping individuals align their financial goals with their lifestyle. Financial advisors carefully assess clients' current financial situation and take into account various factors, including lifestyle choices, to make informed financial planning decisions.

Assessment of Current Financial Situation

Financial advisors begin by conducting a comprehensive assessment of their clients' current financial situation. This involves reviewing income sources, expenses, assets, liabilities, and investment portfolios. By gaining a clear understanding of where their clients stand financially, advisors can tailor wealth planning strategies to meet their specific needs and goals.

Impact of Lifestyle Choices

Lifestyle choices play a significant role in financial planning decisions. Clients' spending habits, saving patterns, and long-term financial goals are all influenced by their lifestyle choices. Whether it's deciding on major purchases, travel plans, or retirement goals, financial advisors consider how these choices impact their clients' overall financial well-being and adjust their wealth planning strategies accordingly.

Aligning Financial Goals with Lifestyle

When it comes to wealth planning services, aligning financial goals with lifestyle preferences is crucial for long-term financial success. By understanding how lifestyle choices can influence financial decisions, individuals can make informed choices that support their overall well-being.

Strategies for Aligning Financial Goals with Lifestyle Preferences

- Creating a budget that reflects both financial goals and lifestyle priorities.

- Setting realistic and achievable financial milestones that cater to lifestyle aspirations.

- Regularly reviewing and adjusting financial plans to accommodate changing lifestyle preferences.

Examples of How Lifestyle Choices Influence Financial Decisions

- Choosing to live in a high-cost city may require adjusting financial goals to account for increased living expenses.

- Opting for a minimalist lifestyle can lead to saving more money for long-term financial goals.

- Prioritizing travel experiences may result in allocating a larger portion of the budget towards leisure activities.

The Significance of Balancing Financial Goals with Personal Values and Aspirations

It is essential to balance financial goals with personal values and aspirations to ensure that money is being used in a way that aligns with one's overall life objectives. By understanding the connection between financial decisions and lifestyle choices, individuals can create a financial plan that supports their well-being and long-term happiness.

Benefits of Aligning Financial Goals

Aligning financial goals with lifestyle choices can have numerous advantages that lead to financial security and peace of mind. By ensuring that your financial goals are in line with your lifestyle, you can set yourself up for a more stable and fulfilling financial future.

Increased Financial Security

When your financial goals are aligned with your lifestyle choices, you are better able to prioritize your spending and saving. This can help you build a strong financial foundation and weather unexpected expenses or emergencies without going into debt.

Peace of Mind

Knowing that your financial goals are aligned with your lifestyle can bring a sense of peace and security. You can feel confident in your financial decisions and have a clear roadmap for achieving your long-term financial objectives.

Case Studies

For example, consider a couple who decides to downsize their home in order to free up cash for travel and leisure activities. By aligning their financial goal of saving for retirement with their desire for a more flexible and adventurous lifestyle, they are able to enjoy their golden years without financial stress.

Final Thoughts

In conclusion, the seamless alignment of financial goals with lifestyle choices emerges as a key factor in achieving financial security and personal fulfillment. This discussion sheds light on the transformative potential of wealth planning services in guiding individuals towards a future where financial well-being harmonizes with their desired way of life.

FAQ Resource

How can wealth planning services help individuals align their financial goals with their lifestyle?

Wealth planning services provide tailored strategies that bridge the gap between financial aspirations and lifestyle preferences, ensuring a harmonious balance for clients.

What are some common examples of financial goals that individuals aim to achieve?

Common financial goals include saving for retirement, purchasing a home, investing in education, and building an emergency fund.

Why is it essential to align financial goals with lifestyle choices?

Aligning financial goals with lifestyle choices helps individuals create a sustainable financial plan that resonates with their values and long-term aspirations.