Kicking off with Private Wealth Management Near Me: Questions to Ask Before Hiring, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Private Wealth Management

Private wealth management refers to the professional management of an individual's wealth and assets by a specialized financial advisor or firm. The key objectives of private wealth management include maximizing investment returns, minimizing risks, and achieving long-term financial goals for the client.One of the primary benefits of hiring a private wealth manager is the personalized approach to financial planning.

These professionals take the time to understand the client's unique financial situation, goals, and risk tolerance before creating a customized investment strategy. They provide tailored advice and solutions to help clients grow and preserve their wealth over time.

Services Offered by Private Wealth Management Firms

Private wealth management firms offer a wide range of services to cater to the diverse needs of their clients. Some of the typical services include:

- Investment Management: Developing and managing investment portfolios tailored to the client's risk tolerance and financial goals.

- Financial Planning: Creating comprehensive financial plans that encompass retirement planning, tax strategies, estate planning, and more.

- Risk Management: Implementing strategies to protect the client's assets from market volatility and unforeseen events.

- Wealth Transfer: Assisting clients in transferring wealth to future generations in a tax-efficient manner.

- Philanthropic Planning: Helping clients achieve their charitable giving goals while maximizing tax benefits.

Qualifications and Experience

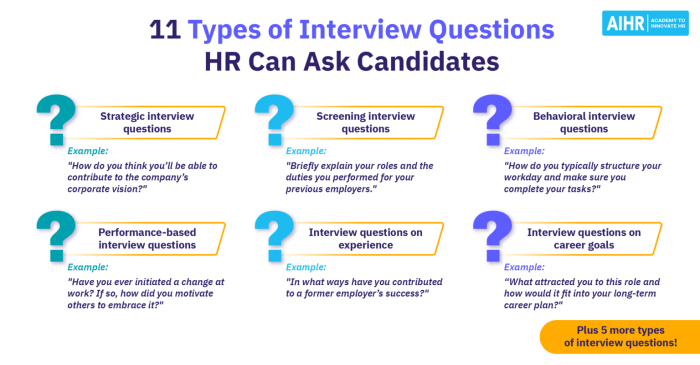

When looking for a private wealth manager, it is crucial to consider their qualifications and experience in the field. These factors can greatly impact the quality of service you receive and the success of your wealth management strategy.

Identifying the Right Certifications and Qualifications

One of the key things to look for in a private wealth manager is their certifications and qualifications. Some of the important designations to consider include:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Chartered Wealth Manager (CWM)

These certifications indicate that the wealth manager has undergone specialized training and has the necessary expertise to handle complex wealth management needs.

The Importance of Experience

Experience plays a vital role in the field of private wealth management. A wealth manager with years of experience has likely encountered a wide range of financial situations and has developed strategies to navigate them successfully.

Working with an experienced wealth manager can provide you with valuable insights and a higher level of expertise when managing your wealth.

Seasoned Wealth Manager vs. New Entrant

While a new entrant to the field may have fresh ideas and a different perspective, there are distinct advantages to working with a seasoned wealth manager:

- Deep industry knowledge and expertise

- Established network of contacts and resources

- Proven track record of success in managing wealth

Ultimately, the decision between a seasoned wealth manager and a new entrant will depend on your specific needs and preferences.

Fee Structure and Transparency

When it comes to private wealth management firms, understanding the fee structure is crucial for making informed decisions. The way fees are structured can have a significant impact on your financial goals and overall investment performance. Let's delve into the different fee structures used by private wealth management firms and the importance of fee transparency for clients.

Different Fee Structures

- Percentage of Assets Under Management (AUM): This fee structure charges a percentage of the total assets managed by the firm. It typically ranges from 1-2% of AUM annually.

- Hourly Rate: Some firms charge clients based on the number of hours spent on managing their wealth. This fee structure is more common for financial planning services.

- Fixed Fee: In this structure, clients are charged a set fee for specific services or a comprehensive wealth management package.

Importance of Fee Transparency

Fee transparency is essential for clients to understand the costs associated with managing their wealth and to assess the value provided by the firm

Comparing Fee Structures

| Wealth Management Firm | Fee Structure |

|---|---|

| Firm A | 1.5% AUM |

| Firm B | Hourly Rate |

| Firm C | Fixed Fee |

By comparing the fee structures of multiple wealth management firms, clients can make more informed decisions based on their individual financial needs and goals.

Investment Approach and Philosophy

When it comes to private wealth management, the investment approach and philosophy play a crucial role in determining the success of your financial goals. It is important to understand how your wealth manager approaches investments and whether it aligns with your objectives.

Typical Investment Approach

Private wealth managers typically adopt a personalized approach to investment management based on the unique needs and goals of each client. They often conduct a thorough financial assessment to understand your risk tolerance, time horizon, and financial aspirations before creating a customized investment strategy.

- Strategic Asset Allocation: Wealth managers may recommend a strategic asset allocation strategy that involves diversifying your portfolio across different asset classes based on your risk profile.

- Active Portfolio Management: Some wealth managers actively manage your portfolio by making tactical investment decisions to capitalize on market opportunities.

- Goal-Based Investing: Wealth managers may focus on achieving specific financial goals, such as retirement planning or wealth preservation, by tailoring investment strategies accordingly.

Importance of Alignment

It is crucial to ensure that the investment philosophy of your wealth manager aligns with your financial goals and risk tolerance. By having a shared understanding of your investment objectives, you can work together effectively to achieve long-term financial success.

Examples of Investment Strategies

Private wealth managers may employ various investment strategies to help grow and preserve your wealth. Some common strategies include:

- Diversification: Spreading investments across different asset classes to reduce risk.

- Value Investing: Identifying undervalued assets with the potential for long-term growth.

- Income Generation: Investing in assets that generate regular income, such as dividend-paying stocks or bonds.

- Alternative Investments: Including non-traditional assets like real estate, private equity, or hedge funds to enhance portfolio diversification.

Client-Centric Services

Personalized services play a crucial role in private wealth management, as they allow wealth managers to cater to the unique needs and goals of each individual client. By tailoring their services, wealth managers can provide more effective and relevant financial solutions, ultimately helping clients achieve their financial objectives.

Customized Financial Planning

Private wealth managers offer customized financial planning services that are tailored to each client's specific circumstances. This may include creating personalized investment portfolios based on the client's risk tolerance, financial goals, and time horizon. By taking into account individual preferences and constraints, wealth managers can design a comprehensive financial plan that aligns with the client's objectives.

Wealth Transfer Strategies

Another example of client-centric services provided by private wealth managers is wealth transfer strategies. Wealth managers help clients develop a plan for transferring their wealth to future generations or charitable organizations. This involves creating tax-efficient strategies and establishing structures like trusts or foundations to ensure a smooth transition of assets according to the client's wishes.

Ongoing Communication and Support

Private wealth managers also prioritize ongoing communication and support to ensure that clients remain informed and engaged in their financial decisions. They provide regular updates on portfolio performance, market trends, and any relevant changes in the financial landscape. Additionally, wealth managers are available to address any questions or concerns that clients may have, offering personalized guidance and support throughout the client's financial journey.

Last Recap

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

User Queries

What qualifications should I look for in a private wealth manager?

Look for certifications like CFP, CFA, or CPWA, which indicate expertise in financial planning and wealth management. Experience in the field is also crucial to ensure knowledgeable guidance.

How do fee structures vary among private wealth management firms?

Fee structures can include flat fees, hourly rates, or a percentage of assets under management. Understanding these structures helps in making informed decisions about costs.

Why is personalized service important in private wealth management?

Personalized service ensures that the wealth manager understands your unique financial goals and tailors strategies to meet your specific needs, enhancing the overall client experience.