Exploring the intricate world of high net worth advisors and their approach to building diversified investment portfolios, this introduction sets the stage for a deep dive into the strategies and benefits of diversification. The following paragraphs will shed light on the importance of diversification, various strategies employed, and key considerations in asset allocation and risk management.

As we navigate through the complexities of investment portfolios, we will uncover the thought processes and decision-making behind creating a well-rounded and resilient portfolio tailored to high net worth individuals.

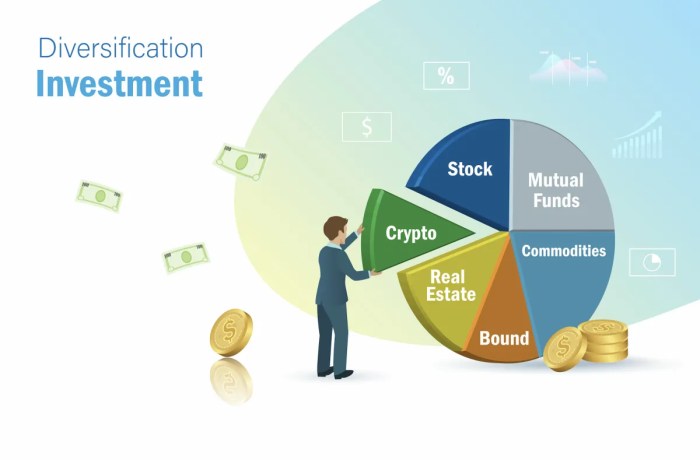

Importance of Diversification in Investment Portfolios

Diversification is a key strategy that high net worth advisors prioritize when building investment portfolios. By spreading investments across different asset classes, industries, and regions, diversification helps reduce risk and enhance potential returns for their clients.

Asset Classes in Diversified Portfolios

- Stocks: Equities provide long-term growth potential but come with higher volatility.

- Bonds: Fixed-income securities offer stability and income generation.

- Real Estate: Property investments can provide diversification and income.

- Commodities: Investments in gold, oil, or agricultural products can offer a hedge against inflation.

Benefits of Diversification

Diversification not only helps in spreading risk but also provides the following benefits:

- Reduced Risk: By not putting all eggs in one basket, diversification helps mitigate the impact of market fluctuations on the overall portfolio.

- Enhanced Returns: Different asset classes perform differently in various market conditions, allowing for potential upside even when some investments are underperforming.

- Stability: Diversification can help smooth out the overall performance of the portfolio, providing more consistent returns over time.

Strategies for Building Diversified Investment Portfolios

Building a diversified investment portfolio requires careful planning and the implementation of various strategies to minimize risk and maximize returns. High net worth advisors use different approaches to achieve diversification, including active and passive investment strategies as well as incorporating alternative investments.

Active vs. Passive Investment Strategies

Active investment strategies involve frequent buying and selling of securities in an attempt to outperform the market. This approach requires a hands-on approach and often involves higher fees due to the active management involved. On the other hand, passive investment strategies aim to replicate the performance of a specific market index by holding a diversified portfolio of securities.

Passive strategies typically have lower fees and are favored by investors seeking a more hands-off approach to investing.

- Active strategies require constant monitoring and decision-making, which can be time-consuming and costly in terms of fees.

- Passive strategies offer lower fees and are more aligned with a buy-and-hold approach, reducing the need for frequent adjustments.

- Both strategies have their pros and cons, and the choice between active and passive investing depends on the investor's risk tolerance, investment goals, and time horizon.

Role of Alternative Investments

Alternative investments such as real estate, commodities, private equity, and hedge funds play a crucial role in diversifying investment portfolios. These asset classes have low correlation with traditional stocks and bonds, providing an additional layer of diversification to the portfolio.

Alternative investments can help reduce overall portfolio risk and enhance returns by adding exposure to different market segments not represented by traditional asset classes.

- Real estate investments can provide stable income streams and potential for capital appreciation.

- Commodities offer diversification benefits by hedging against inflation and currency risks.

- Private equity and hedge funds offer access to unique investment opportunities and strategies not available in public markets.

Asset Allocation and Risk Management

Asset allocation is a crucial component of building a diversified investment portfolio as it involves spreading investments across various asset classes to minimize risk and maximize returns. By carefully distributing assets, investors can reduce the impact of market fluctuations on their overall portfolio performance.

Assessing Risk Tolerance and Time Horizon

High net worth advisors assess risk tolerance by understanding a client's ability and willingness to withstand fluctuations in the value of their investments. They consider factors such as age, financial goals, investment experience, and overall comfort level with risk

By aligning investments with a client's risk tolerance and time horizon, advisors can tailor a diversified portfolio that meets their specific needs.

Managing Risk in Diversified Portfolios

- Utilize Asset Correlation: High net worth advisors incorporate assets that have low correlation with each other, meaning they do not move in the same direction under market conditions. This helps to further diversify the portfolio and reduce overall risk.

- Implement Risk Management Strategies: Advisors may use techniques such as dollar-cost averaging, stop-loss orders, and hedging strategies to protect the portfolio from significant losses during market downturns.

- Regular Portfolio Rebalancing: By periodically reviewing and rebalancing the portfolio, advisors can ensure that the asset allocation aligns with the client's risk tolerance and investment objectives. This helps to maintain diversification and manage risk effectively over time.

Selection of Investment Vehicles

When building a diversified investment portfolio, high net worth advisors carefully select various investment vehicles to achieve their clients' financial goals. These investment vehicles can include stocks, bonds, real estate, and other alternative investments. The criteria considered by advisors when selecting these vehicles often revolve around risk tolerance, investment objectives, time horizon, and market conditions.

Types of Investment Vehicles

- Stocks: Represent ownership in a company and offer the potential for capital appreciation. Advisors consider factors such as company performance, industry trends, and market conditions when selecting stocks for a portfolio.

- Bonds: Debt securities issued by governments or corporations, providing regular interest payments and return of principal at maturity. Advisors assess credit quality, interest rate risk, and inflation expectations when choosing bonds.

- Real Estate: Includes direct ownership of properties or real estate investment trusts (REITs) that generate rental income and potential capital gains. Advisors evaluate property location, rental yields, and economic trends in the real estate market.

Criteria for Selecting Investment Vehicles

- Risk Tolerance: Matching the risk profile of the investor with the risk level of the investment vehicle is crucial to building a suitable portfolio.

- Investment Objectives: Aligning the investment vehicles with the client's financial goals, whether it is capital preservation, income generation, or wealth accumulation.

- Time Horizon: Considering the time frame over which the investments will be held to determine the suitable mix of assets for long-term growth or short-term liquidity needs.

Impact of Market Conditions

- Market conditions play a significant role in the selection of investment vehicles. During periods of economic uncertainty, advisors may shift towards defensive assets like bonds or gold to mitigate risk.

- In a bullish market, advisors may focus on growth-oriented assets such as stocks to capitalize on potential market gains.

Epilogue

In conclusion, the art of building diversified investment portfolios as practiced by high net worth advisors is a delicate balance of risk management, strategic asset allocation, and a keen eye for opportunities. By embracing diversification, advisors can steer their clients towards financial stability and growth in an ever-evolving market landscape.

FAQ Corner

How do high net worth advisors prioritize diversified portfolios?

High net worth advisors prioritize diversified portfolios to spread risk across different asset classes and enhance potential returns through a mix of investments.

What are some common asset classes included in diversified portfolios?

Common asset classes in diversified portfolios may include stocks, bonds, real estate, and alternative investments like private equity and hedge funds.

How do advisors assess risk tolerance and time horizon for clients?

Advisors assess risk tolerance by considering a client's financial goals, investment experience, and ability to withstand market fluctuations. Time horizon is evaluated based on when the client needs to access their funds.

What role do alternative investments play in diversifying portfolios?

Alternative investments like private equity, hedge funds, and commodities offer diversification benefits by having low correlation to traditional asset classes, potentially reducing overall portfolio risk.